Bi weekly mortgage calculator with taxes and insurance

This calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment. So if you have a 6 rate of interest your bi-weekly.

Biweekly Mortgage Calculator

Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

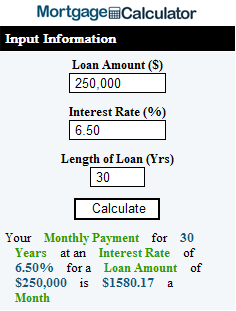

. If you want to calculate your monthly mortgage payment manually or simply understand how its calculated use this formula. Making Bi-Weekly payments will reduce your mortgage term by 50 months and provide interest savings of 27587. Quick view of how much interest you will be paying and your main balance.

Including tax insurance. If you pay your mortgage monthly as most homeowners do that equals 12 payments a year. How Much Interest Can You Save By Increasing Your Mortgage Payment.

For your convenience current Boydton. In making biweekly payments those 26 annual payments effectively create an additional 13th month of regular payments in each calendar year. If you are a homeowner with a.

Elevate your Bankrate experience Get insider access to our best financial tools and content. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. This calculator also allows you to generate amortization schedules for the original loan a loan with extra monthly payments a loan with biweekly payments and a loan with biweekly.

For example if your monthly mortgage payment is 1500 your bi-weekly payment will. Use this calculator to create a depreciation schedule for your current mortgage loan. Ad Our Calculators And Resources Can Help You Make The Right Decision.

As a result you could easily take a 75 rate and the effective interest you would pay could be equal to 615 all without ever refinancing. MP r 1rn 1rn-1 M the total monthly mortgage. Bank Has Online Mortgage Calculators To Provide Helpful Customized Information.

So if you start making biweekly payments you will pay half your normal monthly mortgage. Breakdown of the total monthly payment by principal and interest private. Estimate The Home Price You Can Afford Using Income And Other Information.

For the other costs associated with homeownership including property taxes homeowners insurance PMI HOA fees etc if these expenses are embedded in your monthly home loan. Bank Has The Tools For Your Mortgage Questions. When you choose a bi-weekly schedule it means paying half of your monthly mortgage every two weeks.

Months to Pay Off. Private mortgage insurance PMI 0. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

30 Yrs Previous Number of Payments 1 each payment until Balance 0 26 to convert to years and payments Total Paid Payment Amount rounded up to a full payment 780. Property taxes and insurance.

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator Mortgage Calculator Mortgage Amortization Schedule

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Top 10 Free Mortgage Calculator Widgets

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator Script Free Mortgage Calculator Widget

Downloadable Free Mortgage Calculator Tool

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Can I Afford To Buy A Home Mortgage Affordability Calculator

Mortgage Tax Deduction Calculator Freeandclear

Mortgage Calculator How To Use One Lendingtree

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Mortgage Calculator With Pmi Mortgage Calculator

Mortgage With Extra Payments Calculator

Mortgage Calculator With Pmi Mortgage Calculator